When managing deliveries or international shipping, you’ll often come across the word “tariff.” But what exactly does it mean, and why is it so important for businesses and online sellers?

In this article, we’ll define what a tariff is, explain the different types, and show how it affects shipping costs — especially for those using courier services or e-commerce platforms like EasyParcel.

Contents

What Is a Tariff?

A tariff is a fee or tax imposed on goods that are imported or exported between countries. Governments use tariffs to regulate trade, protect local industries, and generate revenue.

In simpler terms, when a product crosses a border, a tariff may be applied depending on its type, value, and country of origin.

For businesses, understanding tariffs is essential to estimate total shipping costs accurately. Whether you’re importing stock or sending products overseas, tariffs can affect your pricing strategy and profit margin.

Types of Tariffs

Tariffs can vary depending on the nature of the goods and trade agreements between countries. Here are the main types:

Type | Description |

Import Tariff | A tax charged on goods brought into a country. For example, Malaysia may impose import tariffs on certain electronics or clothing to protect local producers. |

Export Tariff | A tax applied to goods leaving a country. Though less common, it helps control the outflow of valuable resources or raw materials. |

Specific Tariff | A fixed charge based on quantity — such as RM10 per item or per kilogram of goods. |

Ad Valorem Tariff | A percentage-based tax on the total value of the goods. For example, 5% of the declared value |

Protective Tariff | Designed to protect local industries by making imported goods more expensive compared to domestic products. |

Why Tariffs Are Important in Logistics and Shipping

Tariffs directly influence how much it costs to move goods across borders. For e-commerce sellers who deliver internationally, understanding tariffs helps in pricing products competitively while still maintaining profit margins.

1. Affect Total Shipping Cost

Tariffs add to the total amount that customers or businesses pay for imported goods. When shipping overseas, even small tariff changes can significantly impact the final price of a product.

By knowing the applicable tariffs beforehand, businesses can plan their pricing strategies more effectively and stay competitive in international markets.

2. Ensure Legal Compliance

Accurately declaring tariff codes is crucial to comply with customs regulations. Incorrect or missing information can cause delays, additional charges, or confiscation of goods.

Maintaining proper compliance not only speeds up customs clearance but also builds credibility with shipping partners and customers.

3. Support Trade Policies

Tariffs are part of a country’s trade policy, designed to maintain fair competition and protect local industries. They also help regulate the flow of goods by balancing imports and exports.

Understanding these trade regulations helps businesses align with international rules and avoid unexpected barriers during shipping.

Once you have these details, you can check the applicable tariff rate on official customs websites or through international courier partners.

With EasyParcel’s cross-border delivery services, you’ll see estimated tariff costs and customs requirements upfront, helping you plan your international deliveries more confidently and efficiently.

How to Check or Calculate Tariffs

To calculate a tariff, you’ll need to understand several key details about your shipment. These factors determine how much you’ll be charged when goods cross international borders.

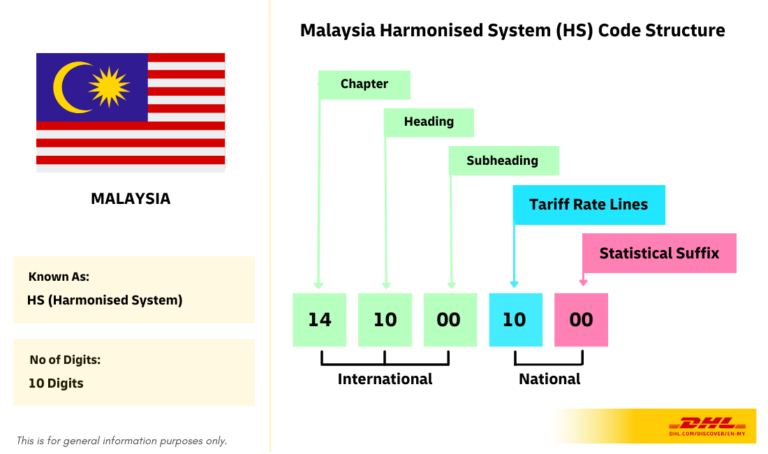

1. The HS Code (Harmonized System Code)

The HS Code is a standardized system used worldwide to classify products. Each product type has a unique code that determines its tariff rate and customs duty.

By identifying the correct HS Code, you can ensure accurate tariff calculation and avoid unnecessary delays during customs clearance.

2. The Country of Origin and Destination

Tariff rates vary depending on the countries involved in trade. Some nations have free trade agreements (FTAs) that lower or eliminate tariffs between them.

Knowing both the origin and destination helps you check whether your shipment qualifies for reduced or special tariff rates.

3. The Value and Quantity of Your Shipment

The declared value and total quantity of goods are used to calculate the final payable tariff. Higher-value shipments usually incur higher duties.

Providing accurate shipment information ensures transparent cost estimates and helps avoid penalties or re-evaluations by customs authorities.

With EasyParcel’s international shipping tools, sellers can easily compare courier rates that already include customs and tariff details. This makes it easier to plan deliveries efficiently to nearby countries like Singapore, Indonesia, and Thailand without surprises in cost or compliance.

How to Ship Items with EasyParcel

- Step 1

- Step 2

- Step 3

- Place the items in the small box.

- Wrap with bubble wrap so it doesn’t get scratched.

- If it’s a branded item, keep the original box inside.

- Seal the package with strong tape and fragile adhesive.

Check the weight with a scale

Check the weight with a scale- Measure the length, width and height

- Log in to your EasyParcel account.

- Enter the pickup and delivery address.

- Enter the weight and size of the package.

- Choose your courier service (J&T, DHL, Pos Laju).

- Add insurance if the item is expensive.

In summary, a tariff is a tax imposed on goods crossing international borders — and it plays a crucial role in global trade and shipping. By understanding tariffs, e-commerce businesses can plan their logistics, set accurate prices, and avoid customs issues.

With EasyParcel, you can make delivery simple, affordable, and efficient — helping your business grow smoothly. EasyParcel welcomes you with a FREE RM10 credit for your first shipment. Sign up today and start shipping smarter with EasyParcel!

FAQs About Tariffs

1. What’s the difference between a tariff and tax?

A tariff is a specific type of tax applied only to imported or exported goods, while general taxes (like GST or VAT) apply to local transactions.

2. Who pays the tariff in shipping?

Usually, the importer (receiver) pays the tariff, but it can depend on the agreement between buyer and seller.

3. Are there tariffs for domestic shipping?

No, tariffs only apply to goods crossing international borders. Domestic deliveries within Malaysia are not subject to tariffs.

Singapore

Singapore Thailand

Thailand Indonesia

Indonesia