If you’ve ever tried shipping anything internationally and got hit with confusing codes and terms, you’re not alone. One of the most common head-scratchers for Malaysian business owners and online sellers is the Malaysia HS code.

But don’t worry — we’re about to break it all down for you in a way that actually makes sense (and won’t make your eyes glaze over 🙃). By the end of this blog, you’ll know exactly what an HS code is, why it matters, how to find the right one for your products, and how EasyParcel makes life easier for you in the shipping world.

Contents

What Is a HS Code, Really?

“HS” stands for Harmonised System, and no, it’s not about harmonising music — it’s a global coding system for classifying goods in cross-border trade.

Think of it like this: an HS code is your product’s international passport. Every item you ship overseas needs a code so customs officers know exactly what it is, how to tax it, and whether it needs special documentation.

In Malaysia, HS codes are governed by Royal Malaysian Customs Department and used for imports, exports, duties, and clearance.

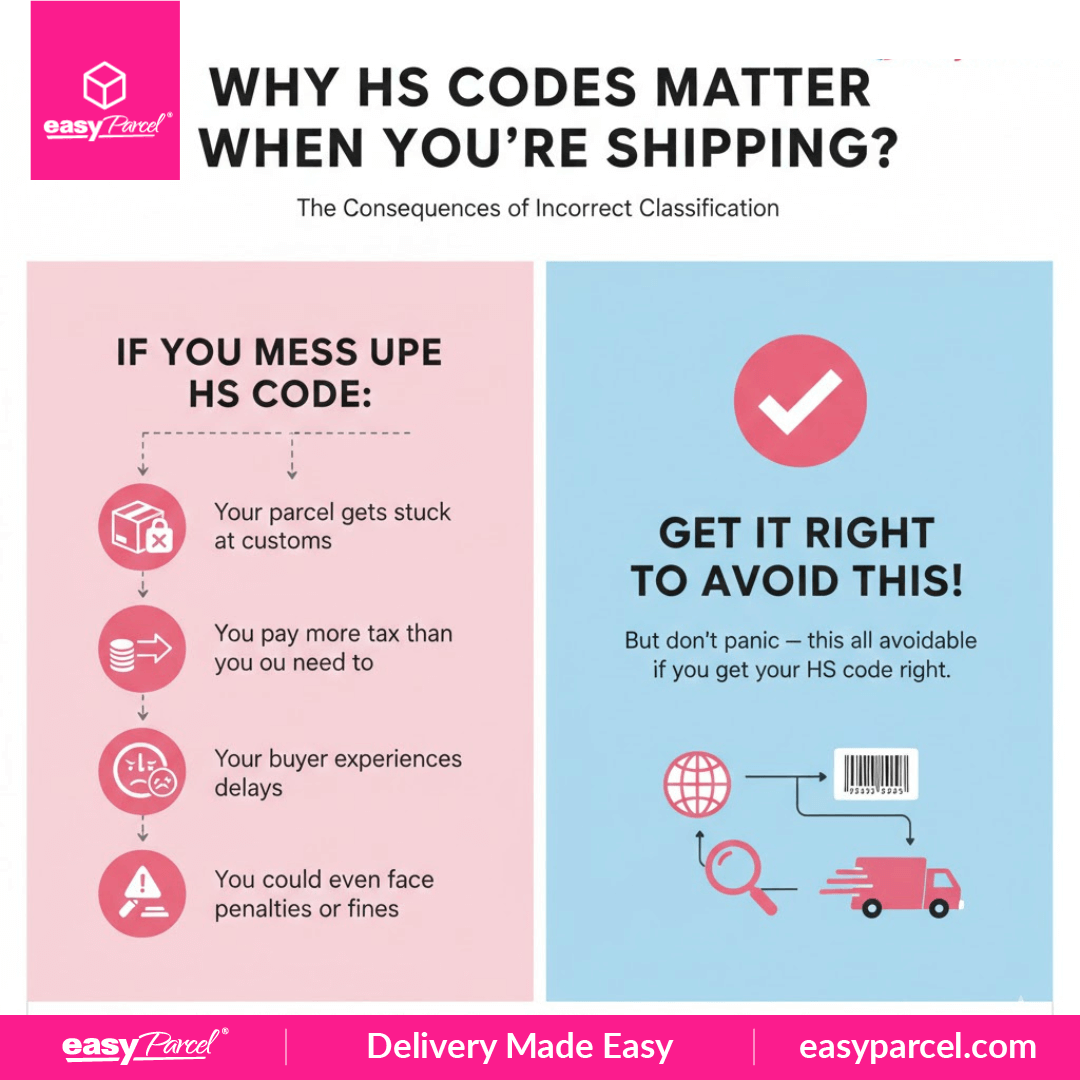

Why HS Codes Matter When You’re Shipping?

Here’s what could go wrong if you mess up the HS code:

❌ Your parcel gets stuck at customs

❌ You pay more tax than you need to

❌ Your buyer experiences delays (and you get that dreaded “Where’s my parcel?” message)

❌ You could even face penalties or fines

Yikes. 😬 But don’t panic — this is all avoidable if you get your HS code right.

Some of Malaysia HS Codes by Product Type

Here’s a cheat sheet with examples of HS codes that are commonly used in Malaysia:

| Product | HS Code | Description |

|---|---|---|

| T-Shirts | 6109.10.00 | Cotton T-shirts |

| Mobile Phones | 8517.12.00 | Smartphones |

| Coffee Beans | 0901.11.00 | Not roasted, not decaffeinated |

| Laptops | 8471.30.10 | Portable computers |

| Beauty Products | 3304.99.00 | Makeup & skincare |

| Instant Noodles | 1902.30.00 | Pasta prepared with seasonings |

You can get the full official list from the Malaysian Customs Tariff Classification (HS Explorer).

How to Find the Right HS Code for Your Product

Finding the correct HS code isn’t as hard as it sounds. Here’s how to do it step-by-step:

1. Use the Malaysian Customs HS Explorer

Go to https://ezhs.customs.gov.my and type in your product name (e.g. “shoes”, “phone case”, “cookies”). You’ll see a list of matching HS codes.

2. Use Keyword Variants

Try searching with different terms. For example, if “mobile phone” doesn’t return results, try “smartphone” or “cellphone”.

3. Match the Description Carefully

Pick the HS code that matches your product’s description as closely as possible. Avoid guessing — customs are picky.

4. Ask the Experts (That’s Us 😎)

If you’re shipping via EasyParcel, you can reach out to our support team – we’ll help you double-check the HS code before you hit “ship”.

Tips To Use HS Code Like a Pro

Always double-check before shipping. Customs regulations can change.

🔹 Keep your HS code consistent for the same item in all your shipments.

🔹 Use the same code your supplier/exporter is using if it matches your product.

🔹 Label your parcel clearly with product names that match the HS code.

🔹 Include the HS code in your invoice or customs declaration form to avoid clearance delay

Sure, HS codes may seem like just another annoying number — but when used right, they can be your best tool to avoid shipping delays, extra costs, and customs nightmares.

So the next time you’re booking a shipment through EasyParcel, don’t just wing it — get your HS code right, and watch your parcels fly smoothly across borders.

Happy shipping, and remember: when in doubt, reach out. We’re always here to help.

Frequently Asked Questions About HS Code Malaysia

What is HS code Malaysia used for?

It’s used to classify goods for customs declarations when importing or exporting items. It helps determine taxes, duties, and whether any restrictions apply.

How do I find my HS code in Malaysia?

You can search for it on the Royal Malaysian Customs HS Explorer website using your product name.

Is HS code required for shipping?

Yes! If you're shipping internationally, you must include the correct HS code in your customs documentation.

What happens if I use the wrong HS code?

Your parcel may be delayed, returned, or taxed incorrectly. In some cases, fines or penalties can apply..

Singapore

Singapore Thailand

Thailand Indonesia

Indonesia