Shipping internationally can get costly and confusing, especially with customs duties. From my experience, using a tax calculator with EasyParcel helps estimate fees, compare courier rates, and manage shipments in one dashboard — making international shipping faster, cheaper, and hassle-free.

Table of Contents

What a Tax Calculator Does

A tax calculator estimates:

Customs duties – Fees levied by the destination country based on the type and value of goods.

Import taxes & VAT/GST – Local taxes applied upon arrival.

- Total landed cost – The final amount the recipient will pay, including shipping, duties, and taxes.

Statement shown in logistics studies: accurate landed cost calculations increase customer satisfaction and reduce failed deliveries.

How I Use a Tax Calculator With EasyParcel

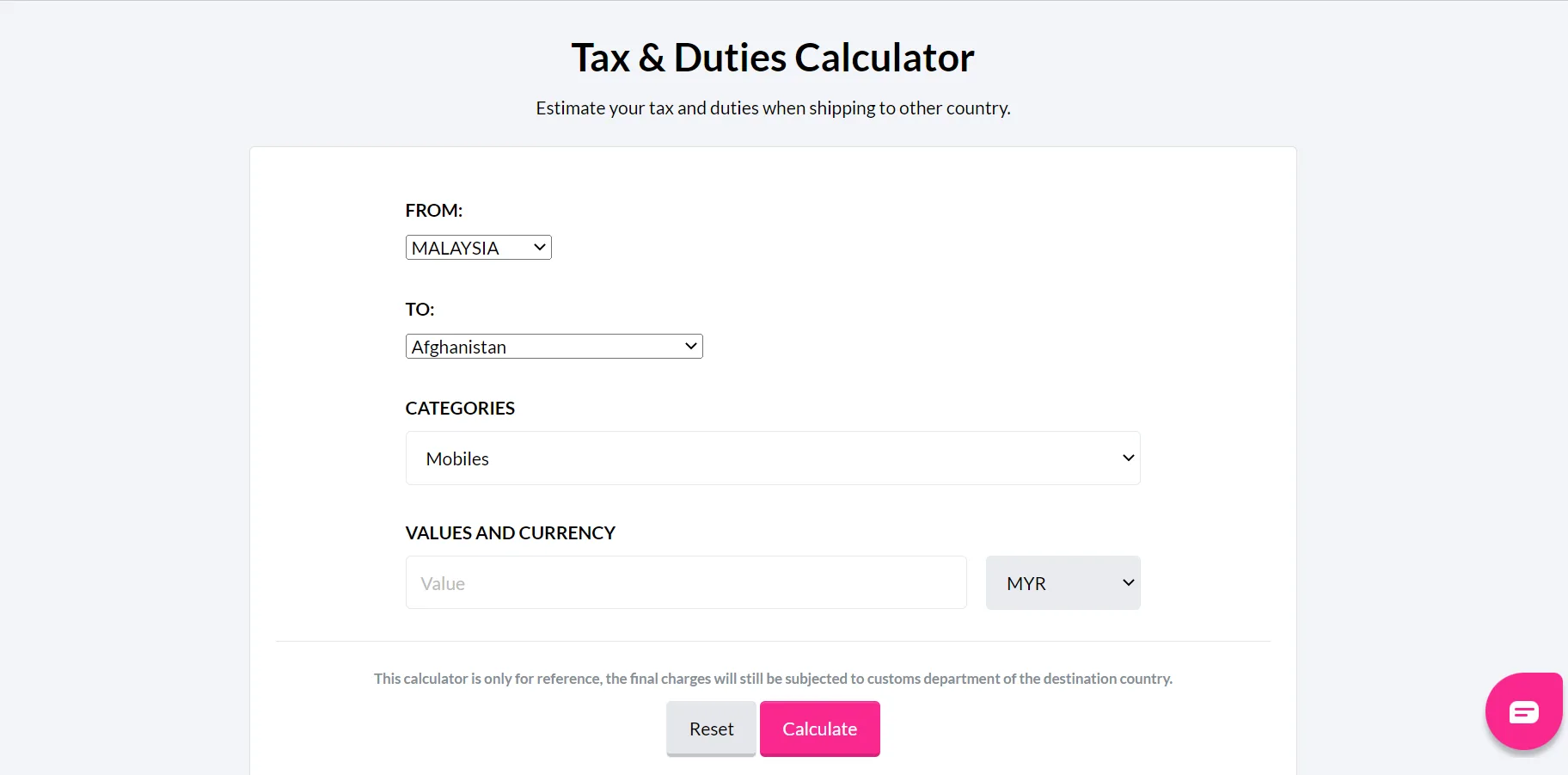

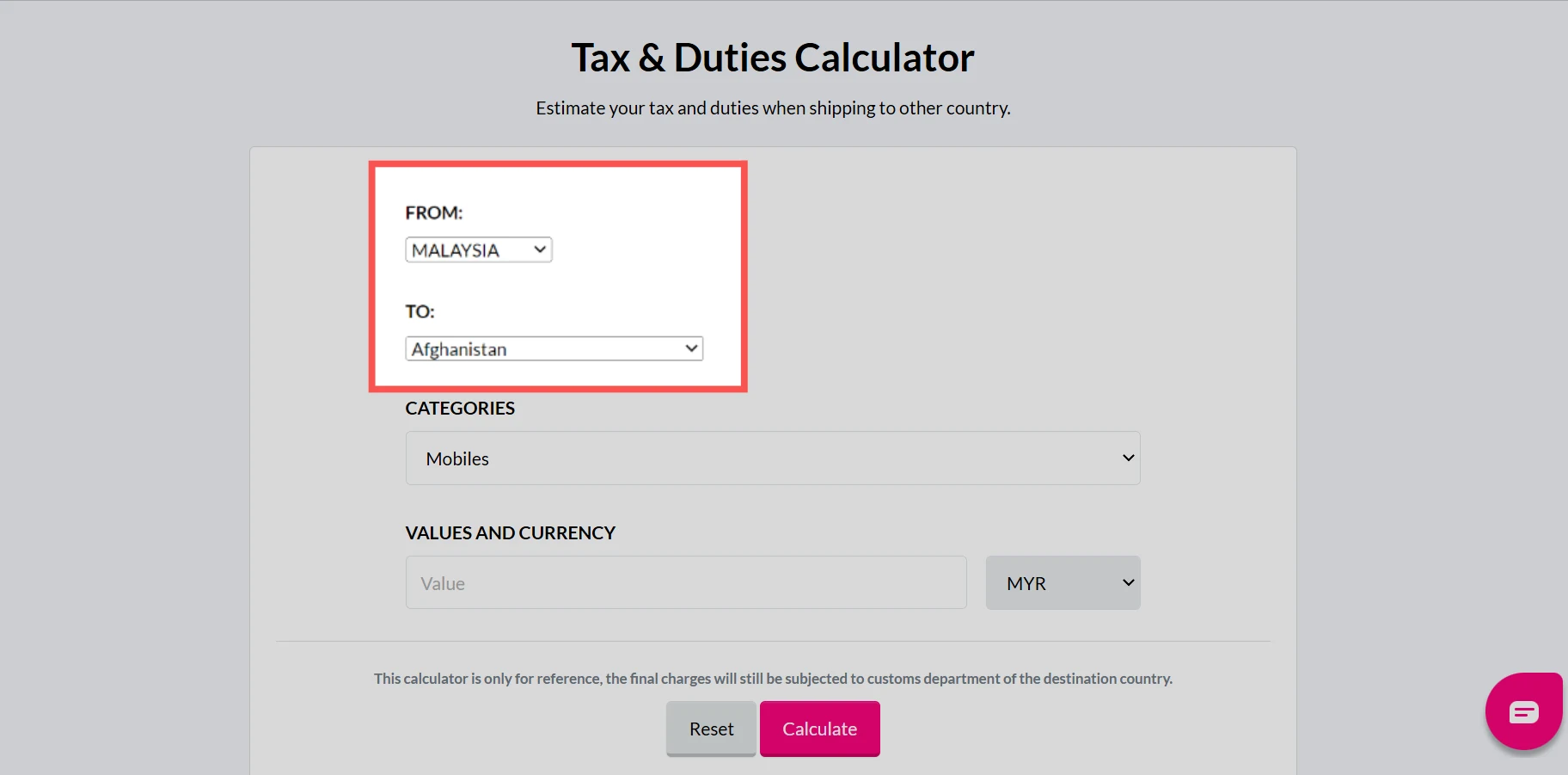

Step 1: Open EasyParcel Tax Calculator.

Step 2: Choose your destinations.

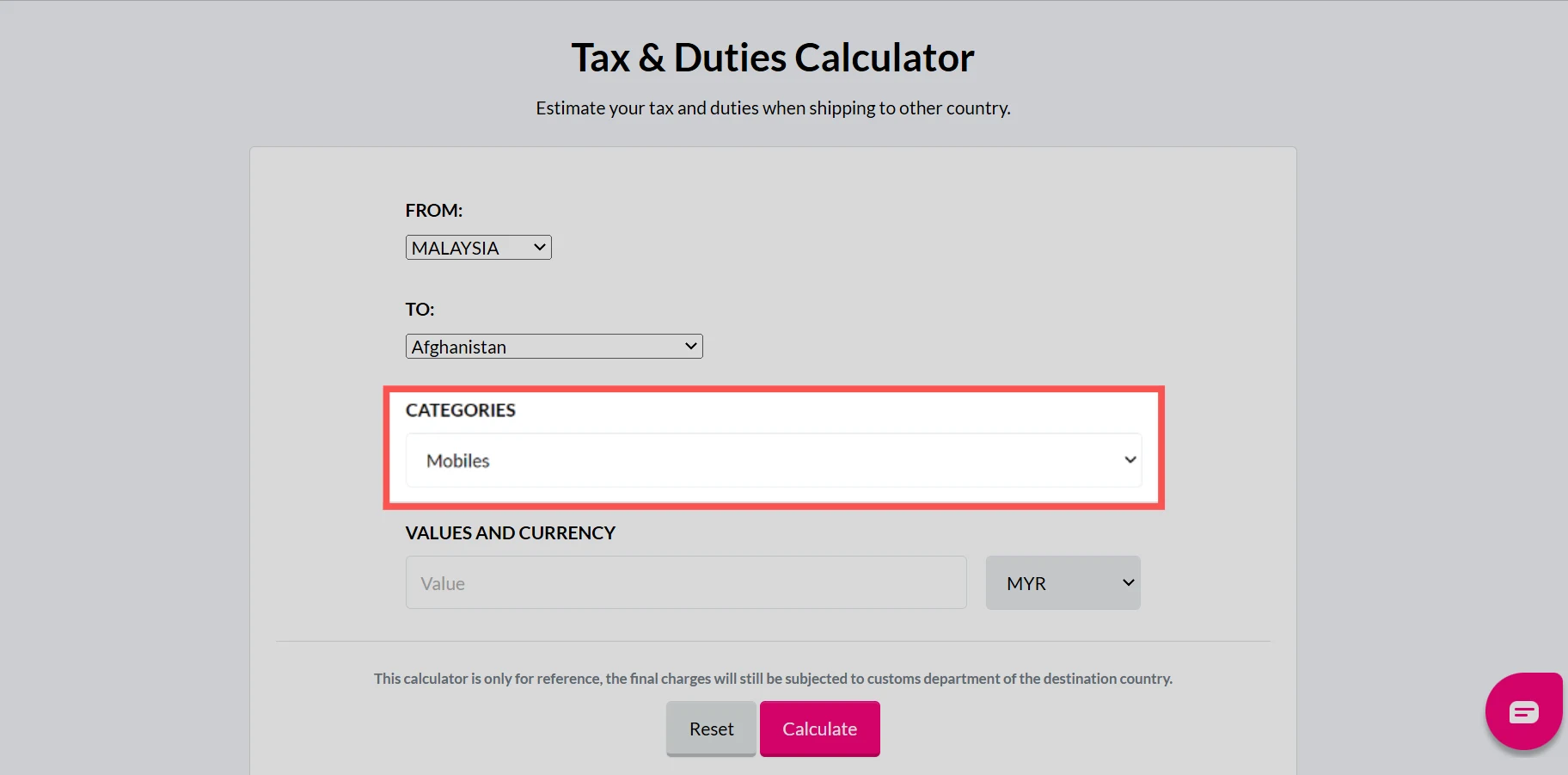

Step 3: Choose the category of the item you are sending.

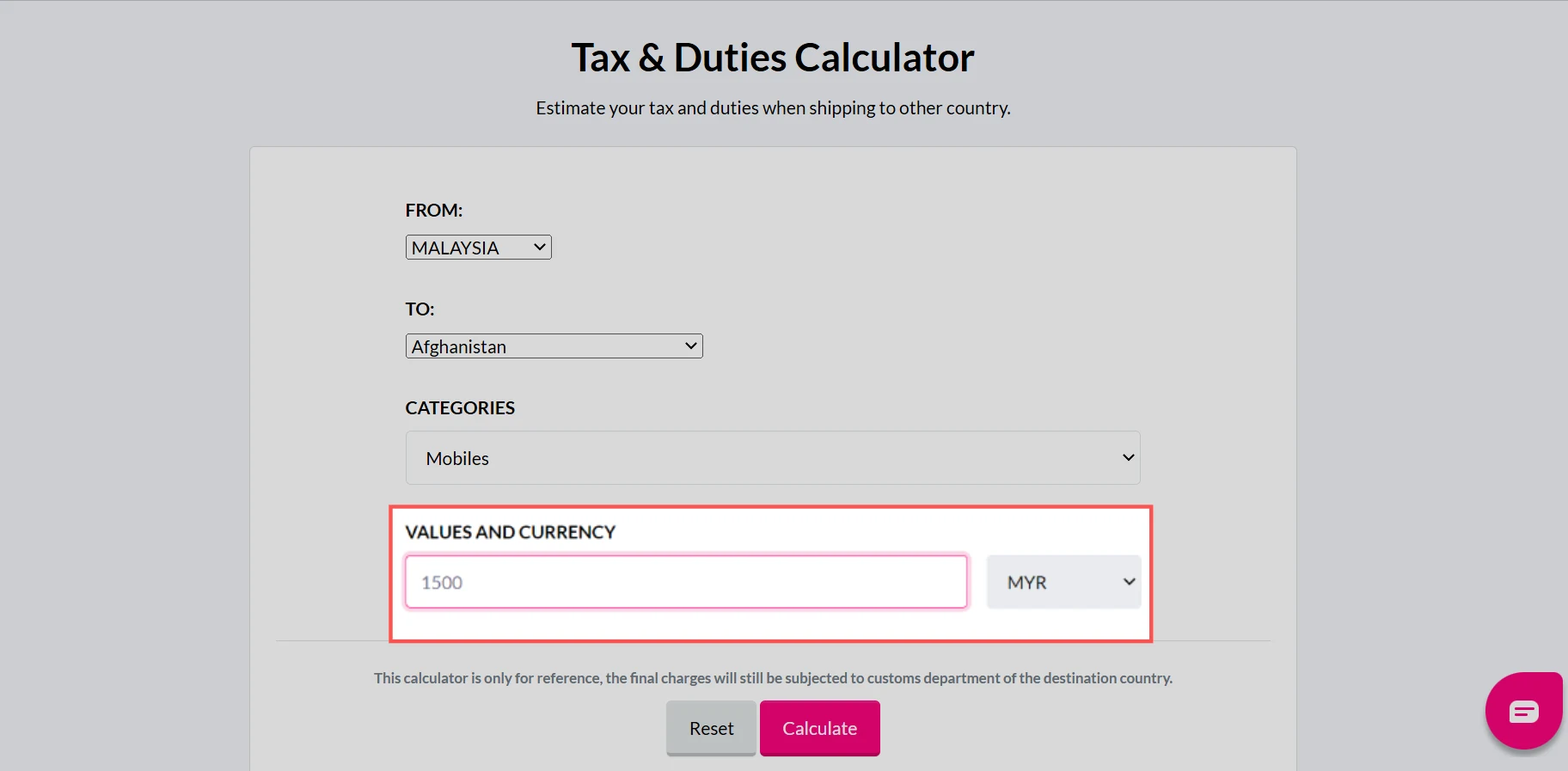

Step 4: Choose the currency & put the value of the item you are sending.

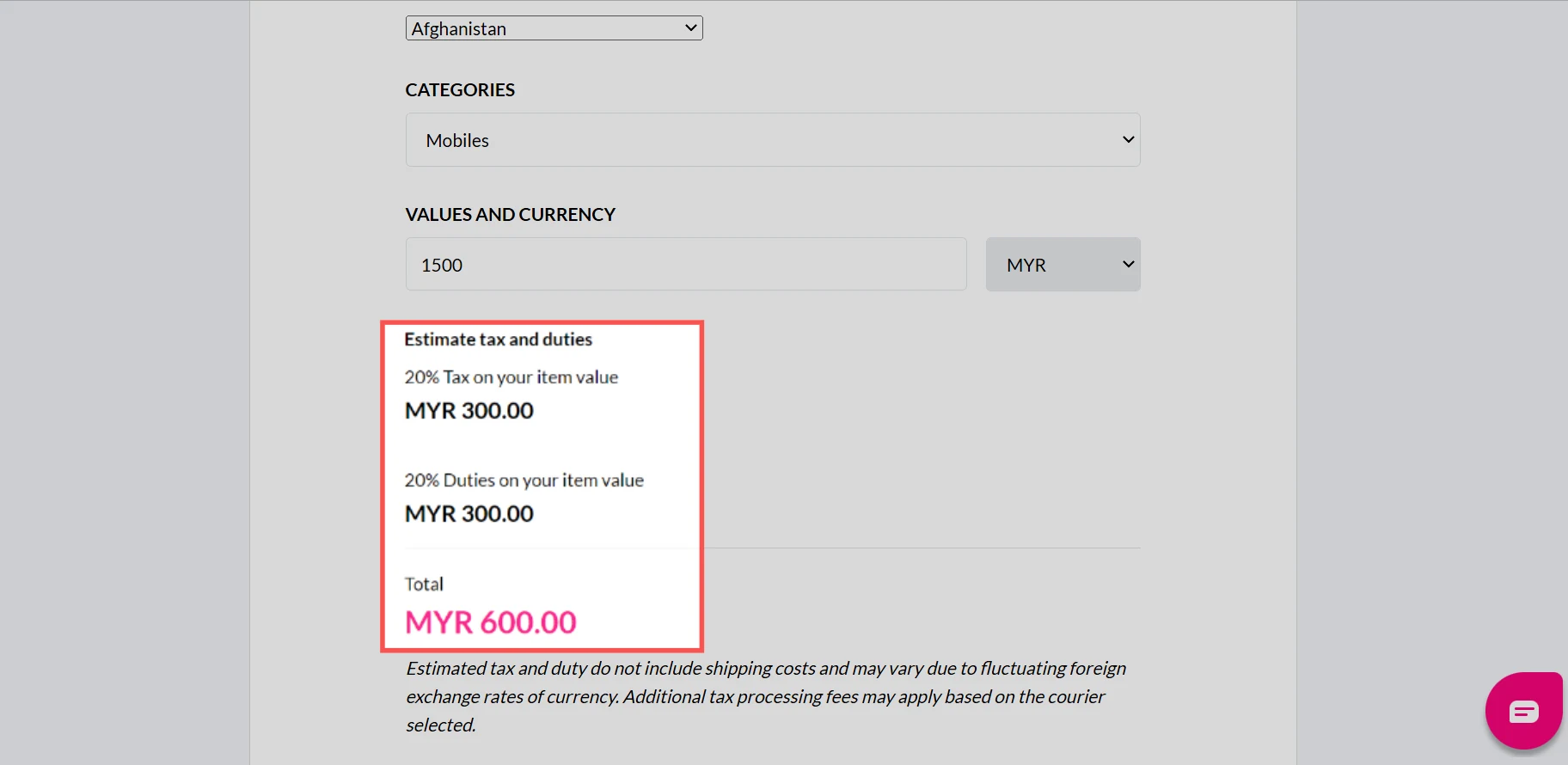

Step 5: The estimated amount of tax & duties will be shown.

Benefits of Using EasyParcel Tax Calculator

Reduce Manual Work

Calculate duties and taxes whitout manual research or complex spreadsheet formulas.

Accurate Cost Planning

Price your products wisely and avoid unexpected fees or losses.

Fewer Returns

Customers are less likely to reject parcels when taxes are clear in advance.

Malaysia

Malaysia Thailand

Thailand Indonesia

Indonesia